“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

Benjamin Graham (Security Analysis)

So, this is the most important definition of what is investing? I took this definition from Warren Buffett guru, Benjamin Graham. It’s the most profound and excellent definition of Investing. It talks about, three most important factors, let’s see one by one

- Thorough Analysis

- Promises safety of principal

- Satisfactory Return.

1) Thorough Analysis

What does that mean? Before investing in any kind of asset, you have to analyze the asset thoroughly. In terms of equity as an asset class, you must analyse the sector, the business of the company, the management, financial and the most important factor is valuation. Basically, thorough analysis means, remain in your circle of competence, if it’s outside your circle, study, learn and expand your circle of competence.

Think about the in and out of the company.

2) Promises Safety of Principal

The safety of principal amount is very necessary, and the asset in which you are going to invest, must promises the safety. But in equity we are going to tell, there is no safety, yes there is no safety, but we can at least secure the downside, by buying on the margin of safety.

To further understand this point, let’s see an example.

You bought a stock of XYZ Company at Rs. 100 and in few days it has down by 50%, so its currently trading at Rs 50, If you want to have a buying price back, XYZ stock has to give 100% return, then your only buying price is back.

So, How you can do that? The answer is simple, protect the downside, the upside will take care of itself. Mohnish Pabrai has a great explanation of this philosophy, Head I win; tell I don’t lose too much. (The Dhandho Investor)

To protect the Downside, you must understand the Difference between Price and Value.

Let’s take the example of Plastic Bottle,

So, what is the price of this plastic bottle? You can easily say, after seeing the MRP. MRP is price, Right,

Which is compulsory to mention on each product, you buy. But What about stocks? Yes, you can see it on exchanges website, apps, and all different website.

It’s not necessary to calculate the price, of the plastic bottle, or stock because it is already mentioned or you can get it easily.

What about the Value?

You have to calculate the value. So how you can calculate the Value of Plastic bottle, you can see the plastic quality, the color of a bottle, brand, toughness and in back of the mind you can easily calculate the value which is below or above the Price.

Suppose the MRP of the plastic bottle is Rs. 30, and after considering the value parameters, you conclude the value of bottle is Rs 15. (It may vary, for the different investor, that’s why valuation is tricky, and it’s more like art than science)

So it’s a big difference between price and value, and of course, it has to be, then the profit will come.

But buying this bottle at Rs 12, then you are on a margin of safety around 25%. So, you can easily protect the downside, by buying on the margin of safety concept and you ultimately promise the safety of Principal.

Warren Buffett Famously said

“Price is what you pay, Value is what you get”

3) Satisfactory Return.

It’s essentially to expect satisfactory return than greedy return, because greed is an emotion, and investor get it wrong is first place.

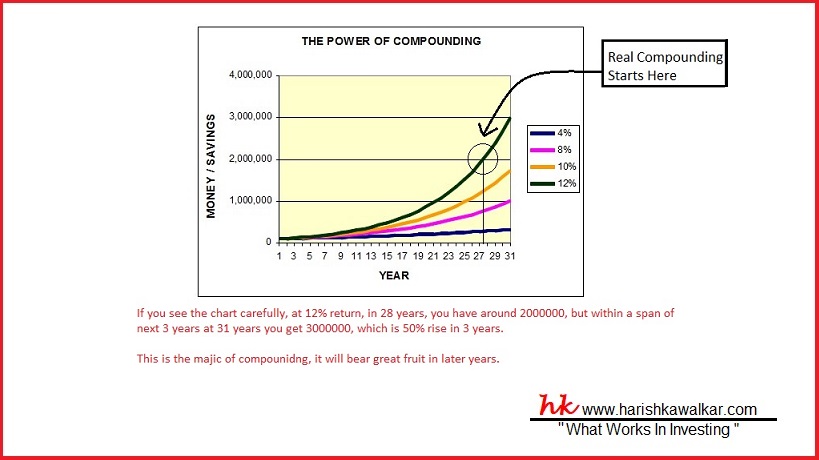

While considering a satisfactory return focus on compounding, and time horizon, longer the investment, it will give you great returns.

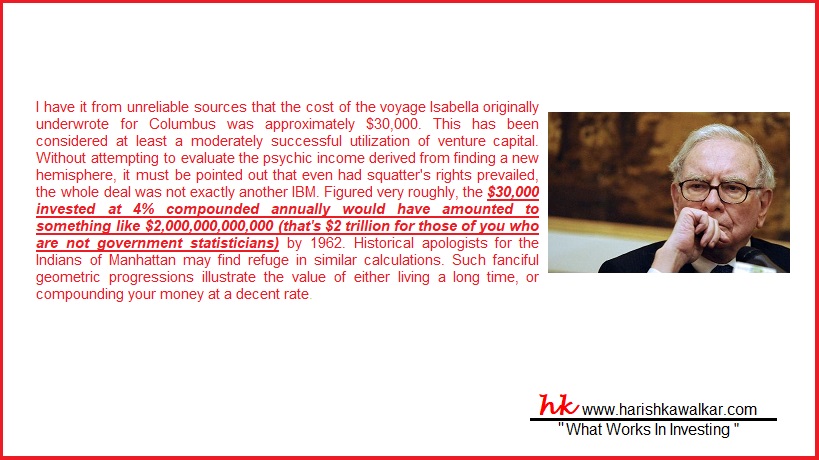

Let’s see examples from Warren Buffett Letters,

The Power of Compounding

See this chart, an even moderate rate of return can create big wealth.

Finally, Remember……..!

“Operations not meeting these requirements are speculative.”

So, No matter, what analyst, media and so-called investment guru says, if an investment not meeting this three parameters are speculative, these are not investment operation.

Video On This Post English Video & Hindi Video

Click Below….!!!!!

(Disclaimer: Data from mention respective sources)

To Your Success with Lot of Love!

Harish S Kawalkar

PS: Ask yourself, who is my most valuable client? If you find the answer, then its right place for you..!!!!! The best letter on the Internet Today, Don’t miss, reading, be ready to learn multidisciplinary thinking and become more successful. Sign up! For http://eepurl.com/E2poT (It’s Free)

Copyright © 2018 All rights reserved