Buffett starts 6 July 1962 letter with the Prediction paragraph, which he was mentioned in 1961 letter dated 24 January 1962, I am not repeating it here again,

In first half of 1962, till 30 June 1962, Dow Declined with the overall loss of 21.7% including dividend,

“A declining Dow gives us our chance to shine and pile up the percentage advantages which, coupled with only an average performance during advancing markets, will give us quite satisfactory long-term results. Our target is an approximately 1/2% decline for each 1% decline in the Dow and if achieved, means we have a considerably more conservative vehicle”

Declining Dow give us opportunity to show better results of Partnership fund, as decline of 0.5% against the Dow 1% decline, if achieved this, then it’s a conservative method of operation.

In first half of 1962 Partnership loss was -7.5% while Dow loss was 21.7%, it’s a approximate 14% advantage over Dow, one year or six month performance not to be taken seriously, Buffett warns partner, because in short period there are lot of chance of fluctuations in performance.

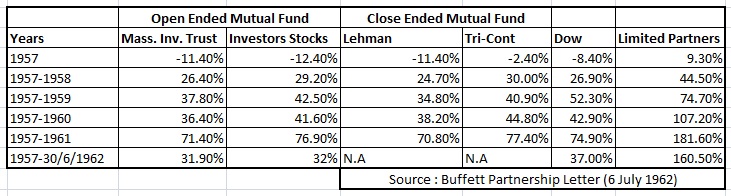

Buffet mention in last year, that Dow is not the right yardstick of performance, so he starts to compare it with two largest open ended mutual funds and two close ended mutual funds,

Massachusetts Investors Trust and Investors stocks are two open ended mutual fund schemes and Lehman and Tri-continental are two closed ended mutual funds, the above comparison shows that, cumulative small advantage over a period of time make huge difference in returns, as from 1957 to 30 July 1962, Open ended mutual fund generates approximate 32% and for that period close ended mutual fund data is not available, but for close ended funds, 1957 – 1961 returns around 71 to 78% approximate, if you compare Limited partners result with both the periods, Limited partners results outshine all mutual funds return, it’s possible because, small advantage over a long period of time, builds great results.

Particularly hard hit in the first half were the so-called “growth” funds which, almost without exception, were down considerably more than the Dow. The three large “growth” (the quotation marks are more applicable now) funds with the best record in the preceding few years, Fidelity Capital Fund, Putnam Growth Fund, and Wellington Equity Fund averaged an overall minus 32.3% for the first half. It is only fair to point out that because of their excellent records in 1959-61, their overall performance to date is still better than average, as it may well be in the future. Ironically, however, this earlier superior performance had caused such a rush of new investors to come to them that the poor performance this year was experienced by very many more holders than enjoyed the excellent performance of earlier years. This experience tends to confirm my hypothesis that investment performance must be judged over a period of time with such a period including both advancing and declining markets. There will continue to be both; a point perhaps better understood now than six months ago.

The growth fund were down more than Dow, previous few years best performance of three mutual funds, Fidelity Capital Fund, Putnam Growth Fund, and Wellington Equity Fund overall loss of -32.3% for first half, previous year excellent performance might compensate the poorer performance of current years, and shows better than average performance currently and in future it may show the same better than average performance.

However this earlier superior performance, may lead to new investor come to invest in funds, despite the poor performance of current year, this confirm the Buffett hypothesis, to judge the investment performance over the period of time, that includes both advancing and declining market.

1 November 1962, Letter:

Buffett send two copies of agreement letter to partners, to be submitted by 1st December, with notarized and signature on it.

While valuing Dempster mill at year end, Buffett apply various discounts to balance sheet such as 40% Discount on inventories, 15% Discount on receivables, estimated auction value of fixed assets, which leads to approximate value or $35 per share.

Overall gain of Buffett Partnership till October was 5.5%, it has 22.3% advantage over Dow,

I want all partners and prospective partners to realize the results described above are distinctly abnormal and will recur infrequently, if at all. This performance is mainly the result of having a large portion of our money in controlled assets and workout situations rather than general market situations at a time when the Dow declined substantially.

Why this 22.3% advantage occur, because BPL had major positions in controlled and workout situations, which insulate the BPL portfolio from General Market,

“The high prices of generals partially forced me into other categories or investment.”

Buffett confess that the high prices of generals (Undervalued Securities) forced to invest in other categories,

Buffett explains great points.

- Buffett invest more conservatively

- One year result not to be taken very seriously

- Outperform the Dow as well as open & close ended mutual fund by investing conservatively.

- Small advantage over a period of time can build fortunes, protect downside, by investing in workouts and controlled situation.

- In Dempster mill case, apply various discount to balance sheet for valuing the business

- When Generals are overvalued moved to other categories

(Disclaimer: All figures and data used from Buffett Partnership Letter (Dated, 6 July 1962 & 1 November 1962), all are my opinions, and this is for educational purpose only. I am not genius or clever to understand all things, I may be wrong in interpreting the data and letter, take your decision on your own)

To Your Success with Lot of Love!

Harish S Kawalkar

PS: Ask yourself, who is my most valuable client? If you find the answer, then its right place for you..!!!!! The best letter on the Internet Today, Don’t miss, reading, be ready to learn multidisciplinary thinking and become more successful. Sign up! For http://eepurl.com/E2poT (It’s Free)

Copyright © 2017 All rights reserved