Few days back I have a discussion with one of my dear friend, Prasad, I always admire him for his rational advice. We are friend from college days, and we have regular discussion on various topic. One day he give me a call and discuss about stock market investing, after discussion I came to know, he has a great wisdom on investing, we exchange our thoughts, and came to know how much return we make till date, he has make great return, but not investing for long term and I show him my return, My holdings are always long term.

He shocked after seen my return, and he asked, Why not you share all this with me, I said I don’t like to show my success, he replied, you are wrong if you have something, you must share, that might help others, you make my loss by not sharing all this things…. We have long debate and discussion… after his advice I am sharing my presentation and my portfolio with public.

Click here My Wealth Creation

Why Prasad shocked, it’s not due to return. There are few reasons, he knows me personally, I don’t have formal financial education like B. Com or MBA in finance; I am a science graduate and post graduation in Marketing, and I have a big problem in mathematics and chemistry, I don’t have any problem accepting my weakness. They remain my problem always.

In discussion I told him, there is no connection between formal financial education and investing success, whatever I learn in investing, I earn from Warren Buffett & Charlie Munger, and I have a my personal rule, I never deviate the rules and thoughts of both the persons.

After doing short course, on “basics of stock market investing” in Pune which cost me around Rs 800 in 2006, I continue my learning, I give maximum time to reading, I read books on Finance, Investing, Economics, Behavioral Finance, and from few good Blogs on internet.

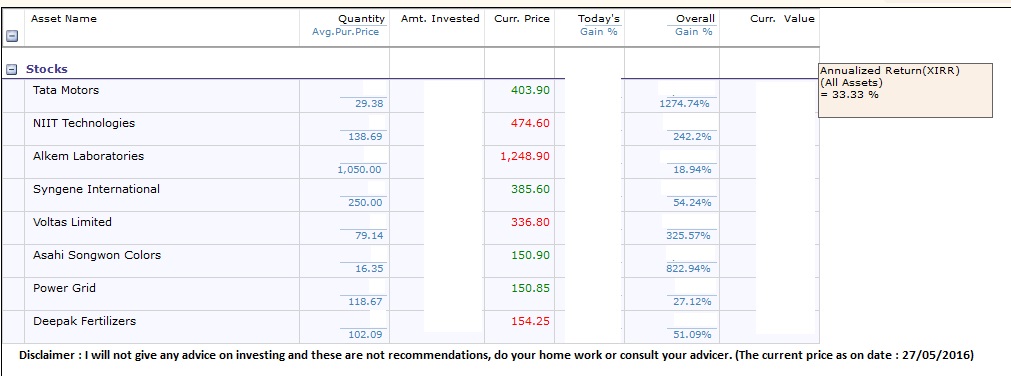

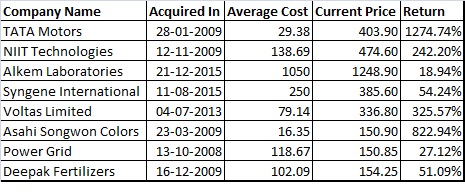

My portfolio:

Why I share all this information? You may have this question in mind. Right

There are few points. I am not a genius who makes money, not at all smart, not having any finance background, but what makes this result great,

- Long term approach

- Discipline

- Patience

- No attention to NEWS

- Buying at Margin of safety

- Continuous learning and reading

- Not paying attentions to short term profits

- Disciplined investing

- Benefits of Compounding

- Remain Invested in Full Market Cycle

- Long Term Capital Gain

- Not listening to TV Gurus

I think anybody can have above qualities, if you invest your little time in learning and reading good books on investing, because money is important and necessary in today’s world. This can bring happiness in your family life.

Don’t just jump and invest.

If you think making money in stock market is simple, then you must read and understand memos of Howard Marks of Oaktree capital. You understand the importance of second level thinking.

There are few points you must understand before taking any action, points are mention below.

Business Analysis

1) Simple and understandable business?

2) Business has a consistent operating history?

3) Business has favourable long-term prospects?

Circle of Competence

1) What is Circle of Competence?

2) Understanding of company’s product and services?

3) Are these products most desired and needed by its customers?

4) Do Customers have a substitute in the market for these products?

Management

1) Is management rational?

2) Is management candid with its shareholders?

3) Does management resist the institutional imperative?

Marin of Safety

1) Concept of Margin of safety

2) What is the value of the company?

3) Purchase at discount to its value?

Financial Analysis

1) Understand Balance Sheet, Profit & Loss and Cash Flow statements

2) What is the return on equity?

3) What are the company’s “owner earnings”?

4) What are the profit margins?

5) Has the company created at least one dollar of market Value for every rupee retained?

Behavioural Economics

1) Introduction to Behavioural Economics

2) Mental Accounting

3) Loss Aversion & Sunk cost fallacy

4) Status quo bias & Endowment Effect

5) Money Illusion & Bigness bias

6) Anchoring & Confirmation bias

7) Overconfidence

8) Information

Market Analysis

1) Understanding the market player? (Media, print, broker)

2) Market player behaviour?

3) Market valuation for buying & selling?

Disclaimer:

The views and opinions expressed or implied herein are my own and do not reflect those of my employer, who shall not be liable for any action that may result as a consequence of my views and opinions.

Registration Status with SEBI:

I am not registered with SEBI under SEBI (Research Analysts) Regulations, 2014. As per the clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”

Details of Financial Interest in the Subject Company:

Currently, I own all stocks which are mention in above article, and my company Kawalkar Investment Consultancy Private Limited have TATA motors in its Portfolio. it is assumed that my views can be biased when I opine about any stock which I own and therefore, have a financial interest. Me and My Company (Kawalkar Investment Consultancy private limited) is not in the business of advisory and we are not providing any consultancy, tips or research reports.

To Your Success with Lot of Love!

Harish S Kawalkar

PS: Don’t miss, reading success letter, be ready to learn new things and become more successful in life. Sign up! For “The Success Letter” http://eepurl.com/E2poT (It’s Free)

Copyright © 2016 All rights reserved

One response to “My Stock Portfolio”

Very good Harish ji..I am really glad to read it..perfect..