Category: Value Investing

-

WARREN BUFFETT PARTNERSHIP LETTER 8 JULY 1964 LETTER REVIEW

In the first half of 1964 DOW advance from 762.95 to 831.50, dividends of 14.40 including the overall return from Dow was +10% Overall Performance Year Overall Results from Dow (1) Partnership Results (2) Limited Partners Results (3) 1957 -8.40% 10.40% 9.30% 1958 38.50% 40.90% 32.20% 1959 20.00% 25.90% 20.90% 1960 -6.20% 22.80% 18.60% 1961…

-

Should I Regret or Should I Learn? My Love Story with the Stock

I bought my first stock on 13 Oct 2008, at the age of 24 years. My journey starts from one stock to another stock, but whenever I invest I always look for long term prospect of my investment. I don’t have any analytical skill or any business skill. That time I have zero knowledge about…

-

Case Study TEXAS NATIONAL PETROLEUM

TEXAS NATIONAL PETROLEUM Read it Step by Step Download PDF …! Step 1 It’s a Workout These are securities whose financial results depend on corporate action rather than supply and demand factors created by buyers and sellers of securities. In other words, they are securities with a timetable where we can predict, within reasonable error…

-

Case Study Dempster Mill Manafacturing Company

Dear Reader, In today’s post. We discuss about the Dempster Mill Manufacturing Company. In which Buffett bought substantial stake, and how he turnaround the company? Its a dramatic story… Must read.. understand and learn from it….!!!! Click on the image below Dempster Mill Example Explains To Your Success with Lot of Love!…

-

Warren Buffett Partnership Letter 10 July 1963 & 6 November 1963 Review

During first half of 1963, Dow delivered plus 10% return including dividends. Buffett views the short term performance (less than three years) have no meaning, because he has control position, that’s the reason the Buffett performance is better in declining market. Buffett performance excluding Dempster Mill was plus 14% At plus 14% versus plus 10%…

-

Howard Marks Memo 1992 Microeconomics 101 Supply, Demand and Convertibles Review

As in this memo, Howard writes about the supply, demand and convertibles. Two principal factors determine the success of any investment; 1) Intrinsic Quality: Intrinsic quality of underlying business, how good the business is? Its better to invest in good companies than bad one, ceteris paribus. [Ceteris paribus is a favourite term of economists. It…

-

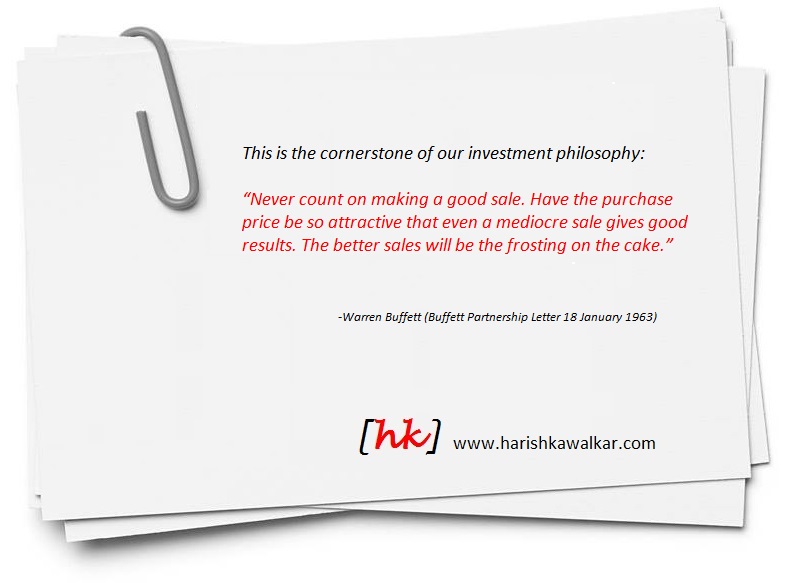

Warren Buffett Partnership Letter 18 January 1963 Review

Buffett knows that his letters are long, and partner had difficulty to read entire letters, so he point out few points, he called it’s a “Ground Rules” Following are the ground rules, please go through it, and the message behind the rules never change, like rule no 1 says no returns are guaranteed to partner,…

-

Warren Buffett Partnership Letter 6 July 1962 & 1 November 1962 Review

Buffett starts 6 July 1962 letter with the Prediction paragraph, which he was mentioned in 1961 letter dated 24 January 1962, I am not repeating it here again, In first half of 1962, till 30 June 1962, Dow Declined with the overall loss of 21.7% including dividend, “A declining Dow gives us our chance to…

-

Warren Buffett Wisdom 1961 (I) Letter

Writing on 1961 performance, Buffett write “We will do relatively well compared to the general market in down or static markets, but that we may not look so good in advancing markets. In strongly advancing markets I expect to have real difficulty keeping up with the general market.” Buffet performance is good till date, and…

-

Howard Marks Memo 1990 The Route to Performance – Review

In Intelligent Investor, one of the great book ever written on value investing by Benjamin Graham, The preface written by Warren Buffett, in that preface Buffett says “To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions…

-

Warren Buffett Wisdom 1960 (II) Letter

From July 1961 Buffett start writing more than one letter for each year, As partners commented that once a year letter was “a long time between drinks” as per Buffett It is not difficult to find something to say twice a year, In first half of 1961 Dow gain was 13% Including dividend, while BPL…

-

Big & Sure Money – Warren Buffett Explained in 1967 Letter

In 1967 Letter to partners Buffett explained the great points, in today’s equity analysis world, people divided in two groups qualitative and quantitative analysis, but Buffett suggest something different, let’s look what he said…… The evaluation of securities and businesses for investment purposes has always involved a mixture of qualitative and quantitative factors. At the…

-

Warren Buffett Wisdom 1960 Letter – Review

Warren Buffett start this letter with general market commentary on 1959 and 1960. As in 1960 the Industrial Average declined from 679 to 616 or 9.3% if dividend calculated the loss will be 6.3%, as per the Buffett guess the 90% of companies outperform the Industrial average. While on New York stock exchange 653 stocks…

-

Warren Buffett Wisdom 1959 Letter – Review

Warren Buffett start this letter with general market commentary and advance decline ratios of stock. Most of the investment group like Tri-Continental corp. had a difficult time in comparison with the Industrial Average. “Most of you know I have been very apprehensive about general stock market levels for several years. To date, this caution…

-

2 Golden Rules Of Warren Buffett On Investment Return Yardstick

In today’s, over calculated, software world, we as an investor always calculates investment return in lot of ways. Investors do the return calculation, as per their own convenience. In today’s investment world, performance measurement in the field of equity investment has been largely corrupted and unclear with terms like, alpha, beta, sharp ratios etc, and…