TEXAS NATIONAL PETROLEUM

Read it Step by Step

Step 1

It’s a Workout

These are securities whose financial results depend on corporate action rather than supply and demand factors created by buyers and sellers of securities.

In other words, they are securities with a timetable where we can predict, within reasonable error limits, when we will get how much and what might upset the apple cart.

Step 2

TEXAS NATIONAL PETROLEUM

TNP was a relatively small producer with which Warren Buffett had been vaguely familiar for years

Step 3

In 1962 Buffett heard rumours regarding a sell out to Union Oil of California. Buffett never acts on such information at rumour stage, he acted on announced stage.

Step 4

TNP had three classes of securities outstanding:

Step 5

The risk of stockholder disapproval was nil. The deal was negotiated by the controlling stockholders, and the price was a good one

Step 6

The only problem was, obtaining the necessary tax ruling.

Union Oil was using a standard ABC production payment method of financing. The University of Southern California was the production payment holder and there was some delay because of their eleemosynary status.

Step 7

This posed a new problem for the Internal Revenue Service, but we understood USC was willing to waive this status which still left them with a satisfactory profit after they borrowed all the money from a bank.

Step 8

When we talked with the company on April 23rd and 24th, their estimate was that the closing would take place in August or September. The proxy material was mailed May 9th and stated the sale “will be consummated during the summer of 1962 and that within a few months thereafter the greater part of the proceeds will be distributed to stockholders in liquidation.”

Step 9

The following are excerpts from some of the telephone conversations we had with company officials in ensuing months:

On June 18th the secretary stated “Union has been told a favorable IRS ruling has been formulated but must be passed on by additional IRS people. Still hoping for ruling in July.”

On July 24th the president said that he expected the IRS ruling “early next week.”

On August 13th the treasurer informed us that the TNP, Union Oil, and USC people were all in Washington attempting to thrash out a ruling.

On September 18th the treasurer informed us “No news, although the IRS says the ruling could be ready by next week.”

Step 10

The ruling was received in late September, and the sale closed October 31st

Step 11

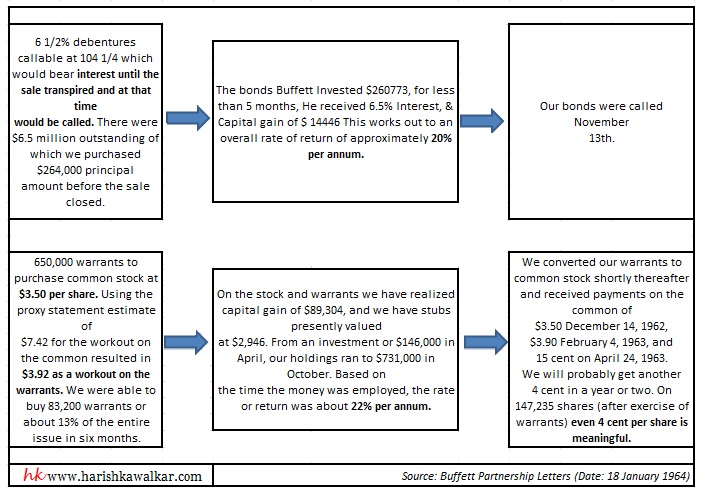

In both cases, the return is computed on an all equity investment. I definitely feel some borrowed money is warranted against a portfolio of workouts, but feel it is a very dangerous practice against generals.

Step 12

We have had workouts which were much better and some which were poorer. It is typical of our bread-and-butter type of operation. We attempt to obtain all facts possible, continue to keep abreast of developments and evaluate all of this in terms of our experience.

Step 13

We certainly don’t go into all the deals that come along — there is considerable variation in their attractiveness. When a workout falls through, the resulting market value shrink is substantial. Therefore, you cannot afford many errors, although we fully realize we are going to have them occasionally.

Learning’s

It’s a Workout, which results depend upon corporate action. (Invest where you have definite gains)

Buffett was familiar with this business, and knows about it from many years. (Track your investment for many years, and invest when you get the opportunity, Be Opportunistic)

Buffett heard rumors regarding this situation, but he never act on it, until it announced from company end, no matter the loss or gain from such situation. (Avoid rumors at all cost)

The risk of disapproval from stakeholders was nil (Know whom with you invest your money)

Tax ruling problem (Know your problems in advance, so you have time to solve it)

Even 4 cent per share is meaningful on 147235 shares (Earn every penny)

I definitely feel some borrowed money is warranted against a portfolio of workouts, but feel it is a very dangerous practice against generals. (Don’t borrow and invest, no matter you get definite money. Buffett Invest borrowed money in Generals, (it’s a undervalued stocks) but not in workouts, control your greed and emotion.)

It is typical of our bread-and-butter type of operation. We attempt to obtain all facts possible, continue to keep abreast of developments and evaluate all of this in terms of our experience. (Find Opportunity, Obtain all Facts, and continue to watch on all developments, evaluate all developments and facts, and Get Results)

We certainly don’t go into all the deals that come along. (Must know when to hit the ball, wait for your pitch, Patience)

To Your Success with Lot of Love!

Harish S Kawalkar

PS: Ask yourself, who is my most valuable client? If you find the answer, then its right place for you..!!!!! The best letter on the Internet Today, Don’t miss, reading, be ready to learn multidisciplinary thinking and become more successful. Sign up! For http://eepurl.com/E2poT (It’s Free)

PPS: If you would like to know the Secrets of Legendry Investors, Buy my EBook

What Works In Investing, The Secrets Of Legendary Investors

Copyright © 2019 All rights reserved