Everyone invests in GOLD. But most of the investors don’t know, why GOLD price rise, despite the bad economic situation? in this post we are learning

- What Is Gold?

- History of GOLD

- GOLD as a Reserve Currency

- Why You Must Purchase GOLD Now &

- Three Reasons Behind The Increase In The Gold Price

What is GOLD

Gold is a chemical element with the symbol Au (from Latin: aurum) and atomic number 79, making it one of the higher atomic number elements that occur naturally. In a pure form, it is a bright, slightly reddish yellow, dense, soft, malleable, and ductile metal. Chemically, gold is a transition metal and a group 11 element. It is one of the least reactive chemical elements and is solid under standard conditions.

Though Gold is quite abundant, because of its high popularity it becomes very valuable. … Another reason due to which gold works well in terms of value is because gold does not readily oxidize thus, it maintains a constant weight. Other metals, such as iron rusts and copper gets oxidized.

History of Gold

The Gold Standard often refer to two key periods in history: that of the Classical Gold Standard and that of the post Bretton Woods gold-pegged exchange rate system. Gold has always played an important role in the international monetary system. Gold coins were first struck on the order of King Croesus of Lydia (an area that is now part of Turkey), around 550 BC. They circulated as currency in many countries before the introduction of paper money. Once paper money was introduced, currencies still maintained an explicit link to gold (the paper being exchangeable for gold on demand). By the late 19th Century, many of the world’s major currencies were fixed to gold at a set price per ounce, under the ‘Gold Standard’ and this persisted in different forms for about one hundred years.

History of Gold – Classical Gold Standard

Classical Gold Standard: The Gold Standard was a system under which nearly all countries fixed the value of their currencies in terms of a specified amount of gold, or linked their currency to that of a country that did so. Domestic currencies were freely convertible into gold at the fixed price and there was no restriction on the import or export of gold. Gold coins circulated as domestic currency alongside coins of other metals and notes, with the composition varying by country. As each currency was fixed in terms of gold, exchange rates between participating currencies were also fixed.

History of Gold – How the Gold Standard worked:

How the Gold Standard worked: Under the Gold Standard, a country’s money supply was linked to gold. The necessity of being able to convert fiat money into gold on demand strictly limited the amount of fiat money in circulation to a multiple of the central banks’ gold reserves. Most countries had legal minimum ratios of gold to notes/currency issued or other similar limits. The international balance of payments differences was settled in gold. Countries with a balance of payments surplus would receive gold inflows, while countries in the deficit would experience an outflow of gold.

In theory, international settlement in gold meant that the international monetary system based on the Gold Standard was self-correcting. Namely, a country running a balance of payments deficit would experience an outflow of gold, a reduction in money supply, a decline in the domestic price level, a rise in competitiveness and, therefore, a correction in the balance of payments deficit. The reverse would be true for countries with a balance of payments surplus. This was the so-called ‘price-specie flow mechanism’ set out by 18th-century philosopher and economist David Hume.

History of Gold – The Bretton Woods system

The Bretton Woods system: It was clear during the Second World War that a new international system would be needed to replace the Gold Standard after the war ended. The design for it was drawn up at the Bretton Woods Conference in the US in 1944. US political and economic dominance necessitated the dollar being at the centre of the system. After the chaos of the inter-war period there was a desire for stability, with fixed exchange rates seen as essential for trade, but also for more flexibility than the traditional Gold Standard had provided. The Bretton Woods system was drawn up and fixed the dollar to gold at the existing parity of US$35 per ounce, while all other currencies had fixed, but adjustable, exchange rates to the dollar. Unlike the classical Gold Standard, capital controls were permitted to enable governments to stimulate their economies without suffering from financial market penalties.

GOLD As Reserve Currency

A gold reserve was the gold held by a national central bank, intended mainly as a guarantee to redeem promises to pay depositors, note holders (e.g. paper money), or trading peers, during the eras of the gold standard, and also as a store of value, or to support the value of the national currency.

“I promise to pay the bearer the sum of rupees” what does it mean?

I Promise to pay….is printed on the currency note just to ensure that the RBI has reserved the gold equal to the value of the printed currency. This promissory note ensures to the note holder that the RBI can’t be a defaulter in any case/situation (Civil war, world war or any natural calamity, depression or hyperinflation inflation, etc). If somebody holds a 100 rupee currency note then he/she needs not worry about its exchange value because in any situation the RBI is liable to pay him gold/goods equal to the value of the 100 rupees.

Why GOLD Now

Gold had served as money for thousands of years until 1971 when the gold standard was abandoned for a fiat currency system. Since that time, gold has been used as an investment. Gold is often classified as a commodity; however, it behaves more like a currency. The yellow metal is very weakly correlated with other commodities and is less used in the industry. Unlike national currencies, the yellow metal is not tied to any particular country. Gold is a global monetary asset and its price reflects the global sentiment.

- Recession / Low Growth ProjectionGold is traditionally seen as a safe investment, especially during a time of financial uncertainty, high inflation, depreciating exchange rates, and economic recession.The main reason is that gold has an intrinsic value. A currency like a dollar or a Rupee can depreciate in value – the value of the Rupee depends on the strength and stability of the Indian economyFor example, hyperinflation (Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy.) (What Causes. Hyperinflation has two main causes: an increase in the money supply and demand-pull inflation. The former happens when a country’s government begins printing money to pay for its spending. As it increases the money supply, prices rise as in regular inflation) can wipe away the value of your savings e.g. Germany 1923, Zimbabwe 2008. During this kind of crisis, gold makes a very good investment.During a recession, gold is seen as a better investment than say the stock market. In a recession, typically stocks will fall as companies make less profit. By contrast, gold is seen as a safe investment for preserving the value of assets. This encourages speculative buying of gold as investors diversify out of other riskier investments.

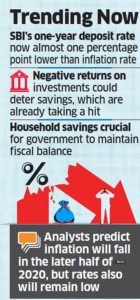

- Negative Real Interest Rates: Gold will also become attractive if we have negative real interest rates. i.e. inflation higher than nominal interest rates. With negative real interest rates, saving in a bank becomes less attractive and gold becomes more attractive. (India’s retail inflation, which is measured by the Consumer Price Index (CPI) is 6.09 percent in the month of June, according to the latest data released by the Ministry of Statistics & Programme Implementation (MoSPI). Interest rates are ranging from 3.30% to 6.50%)A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. A nominal interest rate refers to the interest rate before taking inflation into account.

Banks FD Interest Rates Tenure SBI 3.30% – 6.50% 7 days to 10 years

3 Rupee Depreciation add to Gold Returns

The fall of the Indian rupee will increase the value of gold prices. This is because now you need more money to buy the same quantity of gold.

The value of a nation’s currency is strongly tied to the value of its imports and exports. When a country imports more than it exports, the value of its currency will decline. On the other hand, the value of its currency will increase when a country is a net exporter. Thus, a country that exports gold or has access to gold reserves will see an increase in the strength of its currency when gold prices increase.

But for countries like India which is a net importer of gold, there will be a decrease in the strength of currency if gold prices rise.

So, all these reasons are favorable to boost gold price in the present situation

Disclaimer: All these are my personal thoughts, I may be wrong, my entire calculation may be wrong, I am not liable of your gain or loss. I am not a SEBI registered investment advisor. all are my opinions, and this is for educational purposes only. I am not genius or clever to understand all things, I may be wrong in interpreting the data and, take your decision on your own)

To Your Success with a Lot of Love!

Harish S Kawalkar

PS: Ask yourself, who is my most valuable client? If you find the answer, then it’s the right place for you..!!!!! The best letter on the Internet Today, Don’t miss, reading, be ready to learn multidisciplinary thinking, and become more successful. Sign up! For http://eepurl.com/E2poT (It’s Free)

PPS: If you would like to know the Secrets of Legendary Investors, Buy my EBook

What Works In Investing, The Secrets Of Legendary Investors

Copyright © 2020 All rights reserved